Governments institutions, especially the SEC, have been trying to figure out how to regulate cryptocurrency. I do not envy their position, as cryptocurrency is evolving at breakneck speeds and new concepts and investment strategies are created every month.

One of the highlights have been the SEC subpoena against Mirror Protocol, a DeFi synthetic assets platform that offers mirrored assets, or synthetic assets that mirror the price movement of a traditional asset such as stocks or equities. But what are synthetic assets and why does the SEC care?

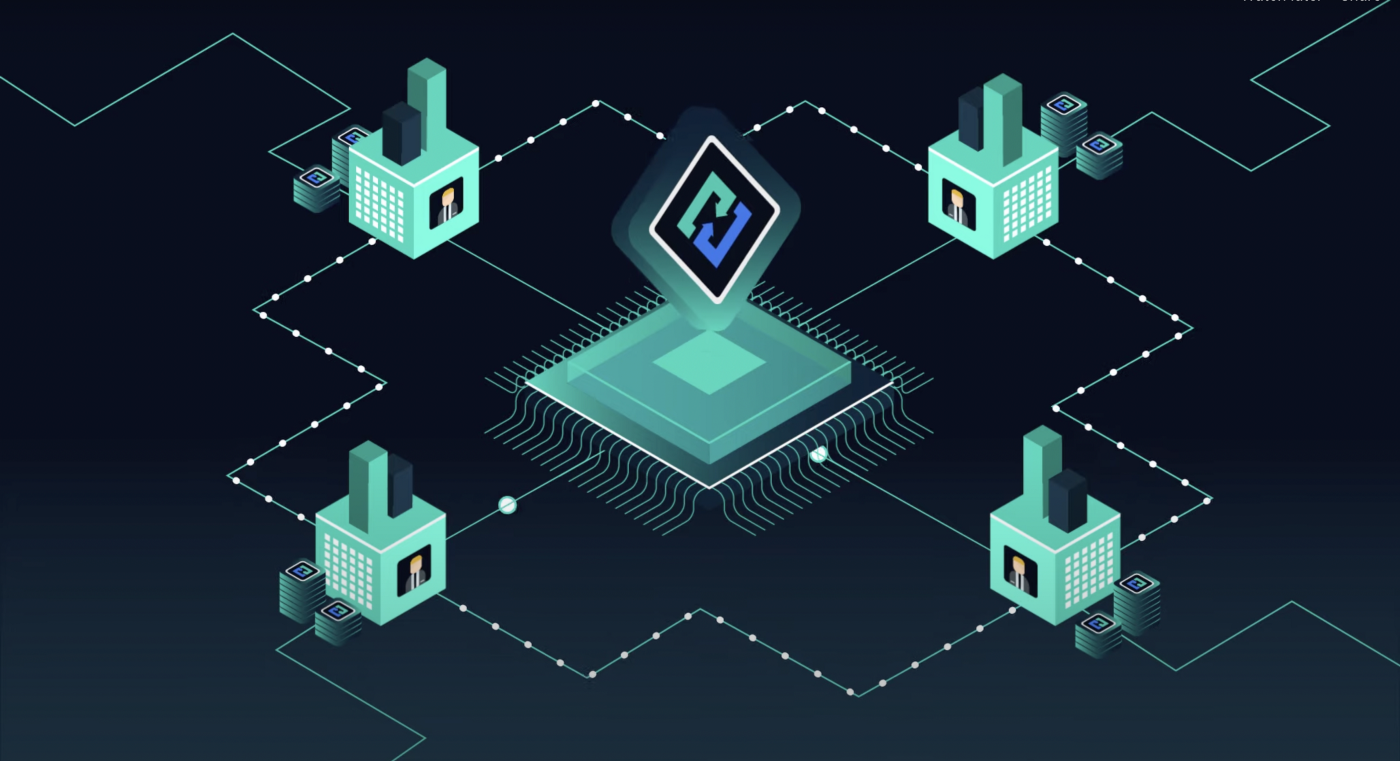

Synthetic assets. From Horizon Protocol

Synthetic assets. From Horizon Protocol

Synthetic Assets vs. Securities

Synthetic assets are tokenized derivatives, financial derivatives leveraging crypto blockchains, which are contracts that represent the underlying value of an asset, without requiring actually holding the asset itself.

Synthetic assets can be derivatives of stocks, tokens, indices, NFTs, or other financial products and a common subset of synthetic assets, mirrored assets, are produced to mimic the original asset in the form of its price movement. For example, a mirrored asset of a stock would mimic the price fluctuations of the stock, while a mirrored asset of a crypto token would mimic the price fluctuations of said token.

A security, on the other hand, is described as the following in Investopedia:

The term “security” refers to a fungible, negotiable financial instrument that holds some type of monetary value. It represents an ownership position in a publicly-traded corporation via stock; a creditor relationship with a governmental body or a corporation represented by owning that entity’s bond; or rights to ownership as represented by an option.

More specifically, the definition of a security was established by the Supreme Court in a 1946 case, where the definition of a security is based on four criteria:

- the existence of an investment contract,

- the formation of a common enterprise,

- a promise of profits by the issuer, and

- use of a third party to promote the offering.

From the definitions, we can actually quite easily determine that there synthetic assets are not securities. Although multiple crypto tokens might fall into this definition, synthetic assets do not because they are neither a part of the formation of a common enterprise nor are they a promise of profit by the issuer. They are not part of the formation of a common enterprise because owning synthetic assets does not mean that you own shares in the company. You only own something that mimics that price movement of the original asset, or shares in this case. Additionally, because synthetic assets are not issued by the common enterprise, there is no promise of profits.

Though synthetic assets most likely will include an investment contract in the form of a smart contract and use third party DeFi platforms to promote the offering, it only fulfills two out of the four criteria required to be defined as a security.

Why does the SEC care?

Synthetic assets are becoming a big market. In an article from December 2021 on CoinDesk, the second biggest synthetic assets DeFi platform, Mirror Protocol, had synthetic assets worth up to $437 million USD, and this is only one project.

It is likely that the SEC is worried about the potential effects and impact of synthetic assets and DeFi derivatives on the traditional finance system and what it means to have other options of investing into the price movement of traditional assets.

Synthetic assets and DeFi derivatives are nascent technologies that are still being tested. There are multiple projects dabbling in bringing different aspects of traditional derivatives on-chain into DeFi and you can find some of them here.

As the Educational Director of a smaller synthetic assets and DeFi derivatives project, Horizon Protocol, I have been spending a lot of time learning more about DeFi and the potential disruption it can bring. I can very strongly state that I am overwhelmed by the possibilities and very excited for what the future holds.

About Horizon Protocol

Horizon Protocol is a decentralized finance project on the BNB Chain with the mission of creating a borderless financial market for synthetic assets.

Horizon Protocol is a DeFi platform that facilitates the on-chain trading of synthetic assets that represent the real economy. Horizon Protocol seeks to provide exposure to real-world assets risk/return profiles via smart contracts on the blockchain.

Learn more about Horizon Protocol.